7 Ways to Get Visibility Into All the SaaS Apps Your Company Uses

SaaS portfolios often sprawl faster than most IT teams can track. When every department punches in a credit card or accepts an OAuth prompt, a new subscription quietly widens the company’s cost and risk profile. The result is blind spots that inflate spend, loosen data governance, and complicate audits.

Finding and fixing those gaps requires proof, not guesses made around a conference table. The evidence already sits in the tools that track cash flow, record sign-ins, log browser traffic, update HR rosters, and expose vendor APIs. By weaving these signals together at the level of line items, logins, or clicks, teams can spotlight redundant licenses, orphaned accounts, and risky shadow tools well before renewals or security events force a scramble. The challenge lies in choosing a starting point and understanding how each feed enriches the next.

Seven data-driven tactics, applied in layers, deliver SaaS owners the wide-angle view they need, from finance ledgers to browser clicks.

Table of Contents

- Follow The Money To Find Apps

- Read SSO Logs To Map Usage

- Watch Browser Traffic For Shadow IT

- Marry HR Data With App Ownership

- Pull Truth Straight From Vendor APIs

- Trace Access Paths In Workflow Docs

- Blend Every Signal Into One View

- Conclusion

Follow The Money To Find Apps

Money trails rarely lie; every SaaS purchase leaves a breadcrumb inside finance tools. When corporate card streams and ERP ledgers flow into expense platforms, the picture sharpens from blurry invoice to crisp line item. A $19.99 charge marked “SLACK*US” appears in NetSuite within hours, even if IT never signed off on the workspace. That speed makes finance data the first alarm bell on subscriptions running outside official channels.

Deploying the feed is straightforward, but turning raw text into insight takes a bit of plumbing.

- Pipe card feeds from Amex and bank APIs into your data lake.

- Map merchant descriptors to clean vendor names, such as changing “GOOGLE*WS” to Google Workspace, using regex or lookup tables.

- Tag anything that repeats on a 30-, 60-, or 90-day cycle as “possible subscription,” then attach contract fields pulled from procurement folders.

- Enrich with GL codes so spend ties back to departments.

- Schedule nightly jobs that flag new vendors over a set dollar threshold.

That workflow captures every dollar, but it cannot pinpoint every user. A single Zoom invoice may mask 300 seats spread across marketing, sales, and contractors. The feed also lags until a charge posts, so a free-trial tool might run for weeks before showing up. Even so, shadow IT eventually pays someone, and that payment hits the ledger.

The payoff from this setup shows up faster than most teams expect. Finance can stack charges by vendor and notice five separate Figma workspaces before renewal season, giving procurement real volume leverage. Security can freeze spend on a risky cloud storage app the same day it surfaces, avoiding weeks of uncontrolled uploads. Departments gain clarity when costs land in their cost centers, ending debates over ownership. Most important, the cycle repeats automatically: detect, verify, act. Within a quarter, organizations often reclaim 10 to 15 percent of SaaS outlay, and the only extra hardware was the spreadsheet you were already paying for.

Read SSO Logs To Map Usage

Your identity provider already maintains an up-to-date list of every sanctioned SaaS login. By tapping into the API endpoints of Okta, Microsoft Entra ID, Ping, or OneLogin you can almost immediately see who can reach what. Each platform exposes an application catalog, group memberships, and clean sign-in trails that usually come at no extra cost. Feed that data into your inventory workflow, and the list of unknowns dries up quickly.

Teams often begin with a simple read-only integration that takes less than an hour.

- Pull the full application list with

GET /api/v1/appsor the Entra Graph equivalent, then write the SaaS name, ID, and status into your source table. - Stitch user objects to those apps by pairing email addresses and last-login timestamps for a clear activity picture.

- Tag any app that shows a 30-day inactivity streak and push that flag to service-desk queues for follow-up.

- Enrich each record with SCIM group tags so you can trace usage back to departments even when HR data lags.

Because the data obeys existing permissions, you can slice it by user, group, or device; finance feeds can’t match that level of detail. The dataset refreshes every few minutes, so stale license counts have nowhere to hide. You will still miss tools that bypass SSO or rely on shared admin logins, and the model assumes people enter through the official portal rather than cached tokens.

Linking sign-in data to license renewal dates transforms negotiations into math, not guesswork. Procurement can point to 152 developers who haven’t opened Jira in ninety days and ask Atlassian for an immediate downgrade, while security closes orphaned accounts before auditors notice. The result is faster rightsizing, fewer privileged accounts, and an evidence trail that proves your least-privilege policy works in practice, not just on paper.

Watch Browser Traffic For Shadow IT

Browser data already moves through every laptop employees use, so tapping that stream uncovers SaaS activity hidden from purchase orders or SSO dashboards. A lightweight extension, about 50 KB rather than another bloated agent, records the domains a tab calls, tags each request, and ships only anonymized hashes until you approve deeper inspection. With traffic grouped by app title, ops teams finally see how many people work in Figma at midnight or sync files to an unvetted CRM.

Rolling out telemetry takes an afternoon when you break it into small, repeatable steps.

- Push the extension through MDM or a simple Group Policy for Windows fleets.

- Publish a clear privacy notice inside Slack, explaining that content stays private while domain-level metadata helps cut risky tools.

- Create an allow list of trusted domains, then flag anything new for a seven-day review window.

- Auto-classify traffic with public WHOIS and Chrome Web Store data, then let analysts enrich edge cases once a week.

- Pipe results into your data lake using standard JSON so nothing gets lost in translation.

Benefits become obvious within days once the data starts flowing. You catch unsanctioned apps before data leaves the building and see feature-level churn nearly in real time, which helps security and procurement speak the same language. Still, visibility stops at unmanaged browsers, and some employees may worry about “keyboard spying,” so legal and comms need to weigh in early. Keep samples small, audit them, and publish the findings; that transparency lowers pushback.

Gartner reports that 60 percent of employees bypass IT at least once a year; each of those clicks carries cost and risk. By watching the browser, you can stop a contractor from storing customer data in a personal Google Drive before it spreads outside controlled boundaries. The telemetry also feeds license-reclamation bots that close idle accounts each Friday. Fewer zombie subscriptions, tighter governance, and smoother audits follow without another heavy agent slowing laptops down.

Marry HR Data With App Ownership

HR data is the missing link between raw usage numbers and clear ownership of every SaaS seat across the company. One new hire or departure can affect dozens of licenses, yet many teams still update spreadsheets by hand and hope nothing slips.

The work starts to move faster once the HRIS becomes the primary record. Connect the Workday or BambooHR API, map common fields, then let scheduled jobs do the heavy lifting.

- Pull a nightly file of employee status, manager, department, and cost-center codes.

- Normalize email addresses and employee IDs to match the values in SaaS activity logs.

- Keep a lookup table that maps nicknames and legal names to one record.

- Store effective and termination dates for quick audit checks.

- Send a webhook that flags any “termination” or “transfer” event for license review.

- Surface mismatches such as users in HRIS but not in any app, or the reverse, to catch provisioning drift early.

The setup makes ownership clear: every seat points to a manager and a budget. Licenses tied to departing staff can land back in the pool within hours, not months. Contractors who sit outside the HRIS and late-logged reorganizations remain blind spots, so a second data source is worth keeping.

Teams usually see material savings within the first quarter of rollout. Gartner puts the waste from inactive users at roughly 25 percent; reclaiming even half of that covers the project. Finance gets clean chargeback files tied to real cost centers, auditors breeze through because access matches employment, and security can prove former staff no longer hold active logins. In short, HR updates become the signal that keeps the entire SaaS stack lean, licensed, and locked down.

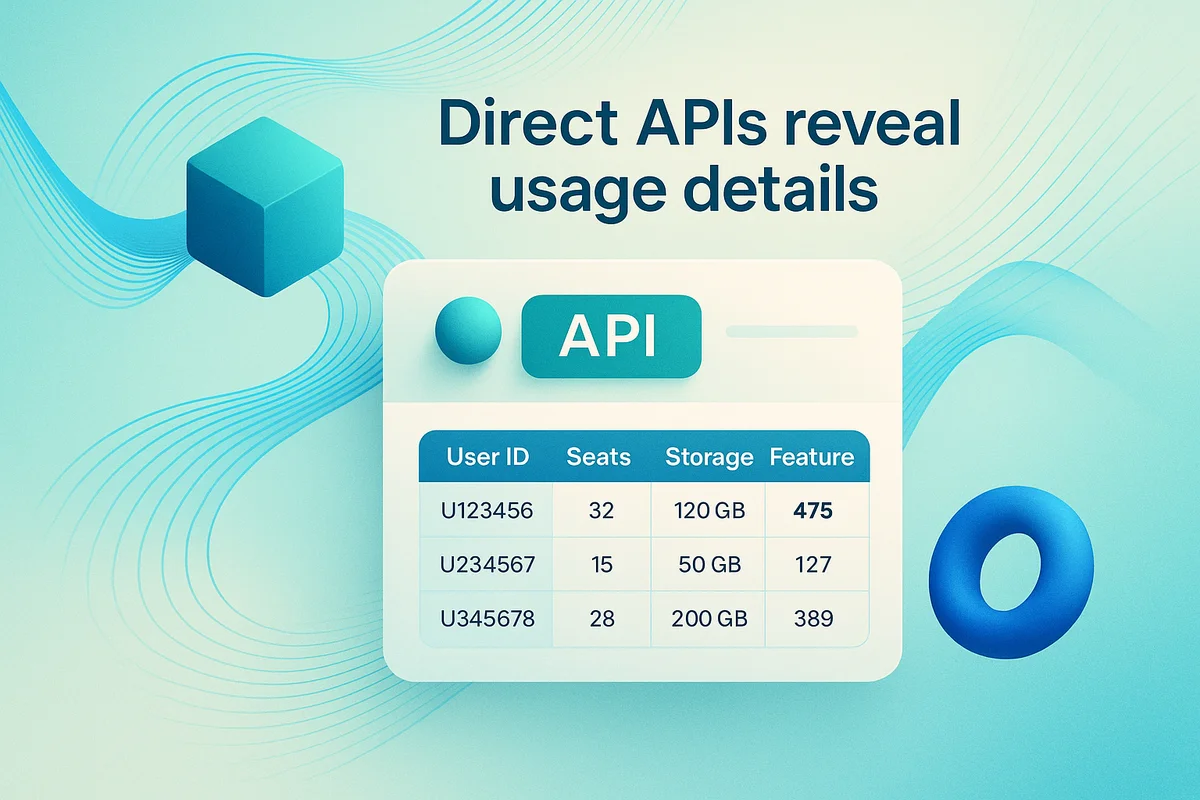

Pull Truth Straight From Vendor APIs

Direct APIs from major SaaS vendors reveal details an invoice never lists. They spill raw counts for seats, roles, storage, and individual feature calls that credit-card feeds omit. Hook into those endpoints and you stop guessing; you know what is in use and what it costs.

Create an API client inside each tenant you care about. Salesforce wants a connected app with the “Manage Users” scope, while Microsoft Graph needs application permissions for Reports.Read.All. Place the client secret in a vault, set up token refresh jobs, then call endpoints such as /services/data/v58.0/limits or /beta/reports/getOffice365ActiveUserDetail. Convert every response into the same table: user ID, license SKU, last activity date. This keeps downstream queries consistent even when one vendor calls a license a “plan” and another calls it a “product.”

The data lands cleanly, but reading it still takes judgment. To keep analysts from drowning in fields, run the feeds through lightweight rules:

- Collapse inactive users older than 90 days into a single “reclaim” queue

- Flag permissions that break corporate policy, such as Zoom hosts with “recording download” enabled

- Match premium add-ons (e.g., Jira Advanced Roadmaps) against project counts to highlight low adoption

Those simple checks quickly turn raw JSON into wins that your finance team notices. Still, the approach has limits: vendors bump API versions, lower-tier plans sometimes block calls, and rate caps can throttle your job.

The payoff from this data work is worth every bit of elbow grease. Microsoft telemetry shows firms trimming 17 percent of unused 365 licenses after three months of Graph audits. A similar scrape of Salesforce often uncovers sandboxes left over from finished projects, saving thousands in storage overages. With that evidence, procurement walks into renewals holding exact seat counts, adoption trends, and a list of premium features nobody uses. The vendor sees the same numbers, discounts arrive faster, and the business stops paying for shelfware.

Trace Access Paths In Workflow Docs

Onboarding checklists and offboarding runbooks quietly map the SaaS tools your company relies on. When HR opens a ticket in ServiceNow or Rippling, the request lists which apps a new hire gets, in what order, and with what role. The same entry shows what must be cut when an employee leaves and how long that usually takes.

Turning those tickets into a living access ledger is simple once the right connectors exist, yet many teams never plug them in.

- Export past tickets and workflow templates through the ITSM API, then drop them into a basic data lake.

- Parse assignment groups and tag every “add to group” or “create account” step as an implied license.

- Compare closed offboarding tickets to current directory status and flag anyone still active.

- Send the gaps back to the workflow owner so the playbook gets fixed before the next hire.

Each step uncovers patterns pure usage logs miss, like why Finance insists every analyst keeps a full Tableau Creator seat instead of Viewer. One query can highlight runbooks untouched for two years even though the SaaS renewed three times in that window.

This approach delivers two practical wins for Finance and security. It captures historical intent, letting procurement see why a team bought thirty Lucidchart seats in Q1 instead of guessing later. It also exposes process drift; Gartner says 20 percent of SaaS spend leaks through orphaned accounts, and most of those hide in forgotten workflows. Still, the method relies on disciplined documentation, so contractors who never hit your HR system can slip through.

That visibility converts to cash once IT shows Finance who owns each license. Chargebacks land faster, renewals happen with clean numbers, and audit teams stop chasing ghosts. Security improves too because every access record ties back to an approved ticket, cutting panic when someone leaves without notice.

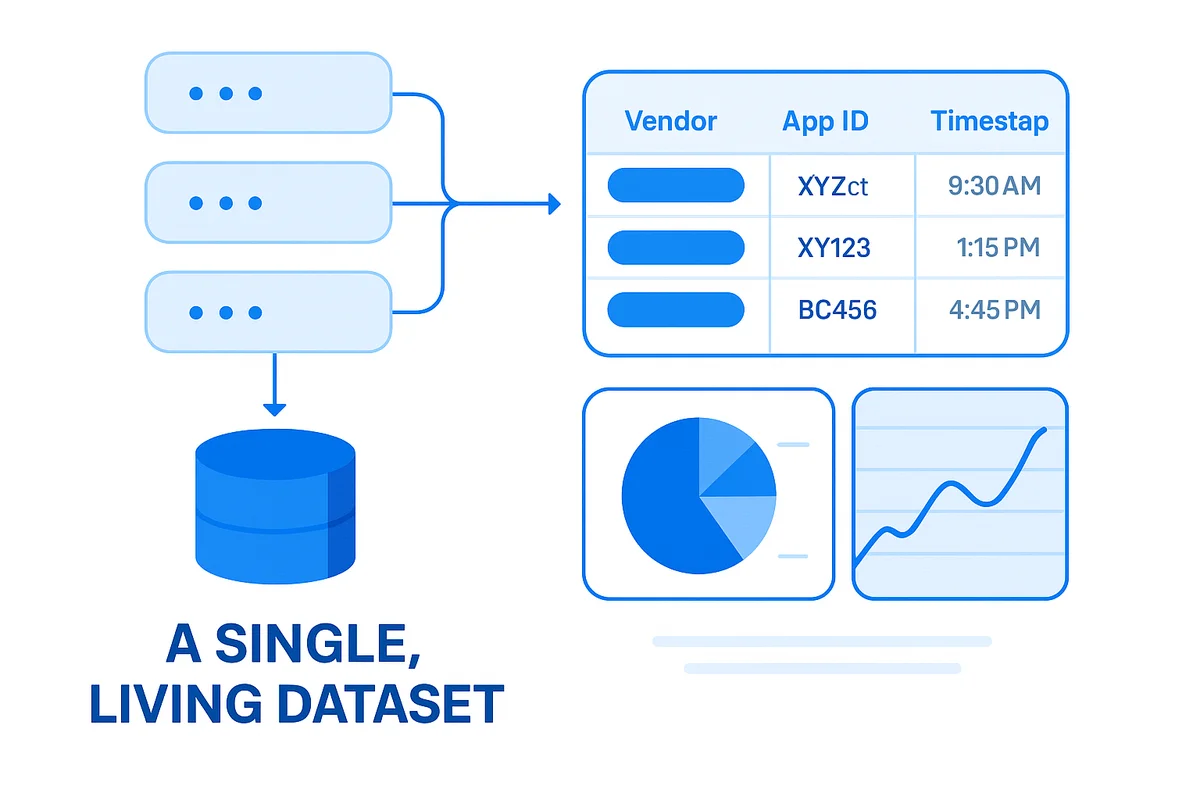

Blend Every Signal Into One View

Raw signals stay weak until they meet in a single, living dataset. When every feed pours into a central lake or a purpose-built SaaS management platform, finance, security, and procurement finally speak the same language. One column carries the normalized vendor name, another the universal app ID, and timestamps keep lineage intact so no one burns hours chasing a mystery charge.

The connective tissue is a lightweight pipeline that runs on a steady cadence.

- Pull and stage data in its original format to keep audits clean.

- Match records with fuzzy logic, then lock them to a canonical app table.

- Convert user identifiers to a single key, usually the corporate email.

- Append cost center, risk score, and renewal date in the same pass.

- Push results to role-based dashboards and trigger webhooks for license reclaim rules.

One pane is useful only when the data stays current, so agree on refresh targets. Nightly ETL covers spend metrics, while browser telemetry might need hourly syncs to catch sudden adoption bursts. The combined view also flags quirks a single source misses, such as a terminated employee still holding a premium Zoom seat or an idle Figma add-on billed to design. Downsides remain. Each new integration adds maintenance work, and winning trust for a shared dashboard takes more than clean code. Still, the return is ongoing rationalization: fewer redundant apps, right-sized licenses, and a solid system of record when auditors arrive.

Conclusion

Collecting every breadcrumb of spend and usage reveals the real SaaS footprint. When finance feeds, SSO logs, browser data, HR records, vendor APIs, and workflow archives converge in a single view, teams can see every subscription, user, and dollar before costs or risks swell. With each source filling the gaps left by another, IT can trim waste and tighten control.

Pulling those seven data streams into one platform eliminates blind spots and creates a living system of record. That system steers renewals, hardens security, and clarifies SaaS ownership.

Audit your company’s SaaS usage today

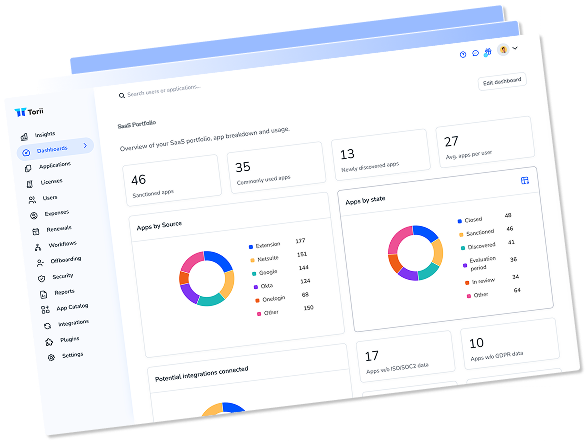

If you’re interested in learning more about SaaS Management, let us know. Torii’s SaaS Management Platform can help you:

- Find hidden apps: Use AI to scan your entire company for unauthorized apps. Happens in real-time and is constantly running in the background.

- Cut costs: Save money by removing unused licenses and duplicate tools.

- Implement IT automation: Automate your IT tasks to save time and reduce errors - like offboarding and onboarding automation.

- Get contract renewal alerts: Ensure you don’t miss important contract renewals.

Torii is the industry’s first all-in-one SaaS Management Platform, providing a single source of truth across Finance, IT, and Security.

You can learn more about Torii here.

Frequently Asked Questions

Effective tracking of SaaS expenses involves integrating finance tools to monitor purchase patterns, mapping vendor names, and tagging recurring charges to identify potential subscriptions.

SSO data helps manage SaaS applications by providing detailed user access logs, which assist in identifying app usage and ensuring compliance with licensing agreements.

Browser data can uncover hidden SaaS activity by tracking domains accessed by users, identifying applications that bypass purchase orders or SSO systems.

HR data links employee status to SaaS licenses, allowing organizations to quickly adjust license counts based on new hires or terminations, optimizing spend.

Vendor APIs provide granular data on user counts, roles, and individual feature usage, helping organizations track SaaS utilization and streamline costs effectively.

Workflow documents outline application assignments during onboarding and offboarding, helping to establish clear accountability for SaaS tool usage and minimizing rogue accounts.

Combining multiple data feeds offers a comprehensive view of SaaS expenses and usage, enabling more informed decisions regarding renewals, security, and cost optimization.