How SaaS Management Platforms Help During M&A

Mergers mash two SaaS estates into one messy whole. Overlapping apps, duplicate fees, and hidden risks lurk behind dozens of sign-ins. IT teams often have just days to untangle everything before finance sets synergy targets and security prepares for auditors.

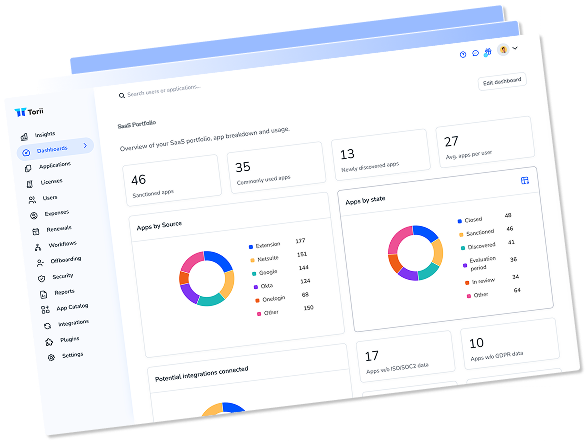

A SaaS Management Platform pulls every cloud subscription from both companies onto one screen as soon as the deal lands. API discovery, SSO logs, spend data, and shadow IT scans create an automated software bill of materials. Dashboards then guide contract consolidation, seat trimming, and vendor risk checks. No spreadsheet fishing required.

This piece explains how that single source of truth turns M&A sprawl into clear savings and tighter control.

Table of Contents

- Instantly see every tool across both teams

- Combine licenses fast and cut waste

- Keep compliance tight as stacks merge

- Ongoing governance that protects post-deal savings

- Conclusion

- Audit your company's SaaS usage today

Instantly see every tool across both teams

M&A moves fast; software records lag. The gap invites risk and extra cost. A SaaS Management Platform closes that gap by turning every login, payment line, and API handshake into one live inventory the minute the deal hits the press release.

Single sign-on logs pour in. Corporate cards add vendor charges. A lightweight browser extension catches direct sign-ups. Together they sweep both companies without touching a spreadsheet. The result lands on a dashboard that any IT or finance lead can open and filter by domain, cost center, or legal entity.

- API discovery ties each user to every tool they touch.

- Shadow IT scans flag apps that never passed through procurement.

- Card feed aggregation pulls in spend that never rode through accounts payable.

- Auto tags group apps under “Acquiree” or “Parent” in seconds.

Tension drops fast. Instead of Version A and Version B of the same CRM hiding on separate sheets, the overlap lights up in red on one screen. Duplicate Zendesk fees sit side by side. A license with no active users shows as “orphan.” When external advisers ask for “all software in scope,” the export takes five clicks, not five weeks.

The audit trail holds up. Every app shows its first discovery date, the user who triggered it, and the payment source. That matters when bankers and auditors compare the closing balance sheet to the integration plan.

Centralized visibility sets the stage for the harder work of consolidation and risk review later. More important, it earns early trust across both leadership teams. They see the same numbers at the same time and can start debating strategy instead of guessing what tools exist.

Combine licenses fast and cut waste

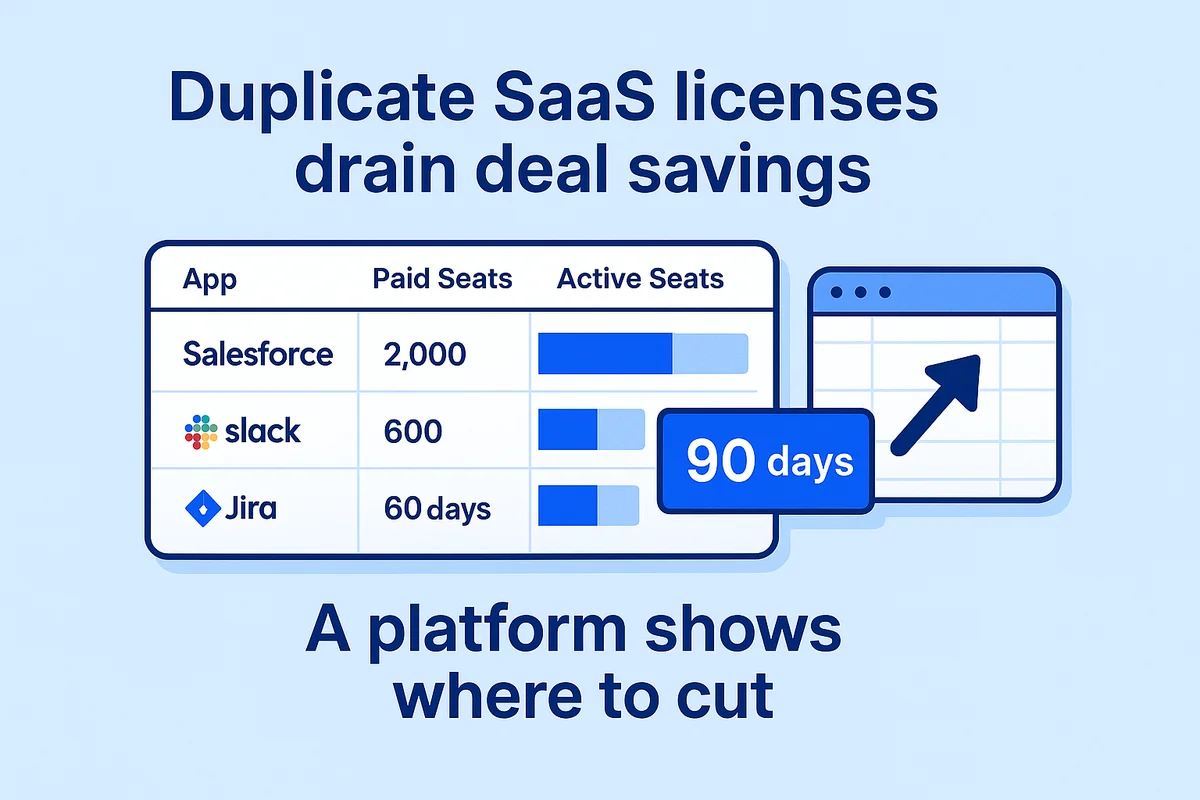

Duplicate SaaS licenses drain deal savings. A platform shows where to cut.

Seat-level data streams in from each vendor API and SSO log. The dashboard ranks apps by paid seats, active seats, and last login. A Salesforce plan with 2,000 seats often turns out to have 600 people who haven’t logged in for 90 days. Slack, Jira, Adobe; same story. Color-coded bars flag the overage so IT can shut off, downgrade, or reassign the seats before the next invoice lands.

Then there’s contract sprawl. A merger usually means two, sometimes three, agreements for the same vendor. The platform lists every term side by side: start date, renewal window, price per seat, legal clauses. It also calls out ideal co-term options.

Bulk actions speed the cleanup:

- Auto-generated reports sort users by inactivity thresholds of 30, 60, and 90 days.

- One click triggers a deprovision workflow across multiple apps at once.

- Role-based templates reassign freed seats to new hires without extra cost.

- Renewal calendar alerts land in Slack so procurement can queue vendors for a bundle negotiation.

License reharvesting keeps business running while rightsizing spend. A marketing manager leaves, her Adobe seat goes straight to a designer on day one. No purchase order, no waiting.

Most companies see 25 to 40 percent less SaaS spend in the first 90 days. The CFO wants hard numbers, so the platform tracks gross savings, one-time clawbacks, and avoided renewals in real time. Every line ties back to an invoice, giving auditors and board members a clear paper trail. The result: those synergies hit the balance sheet instead of the back burner.

Keep compliance tight as stacks merge

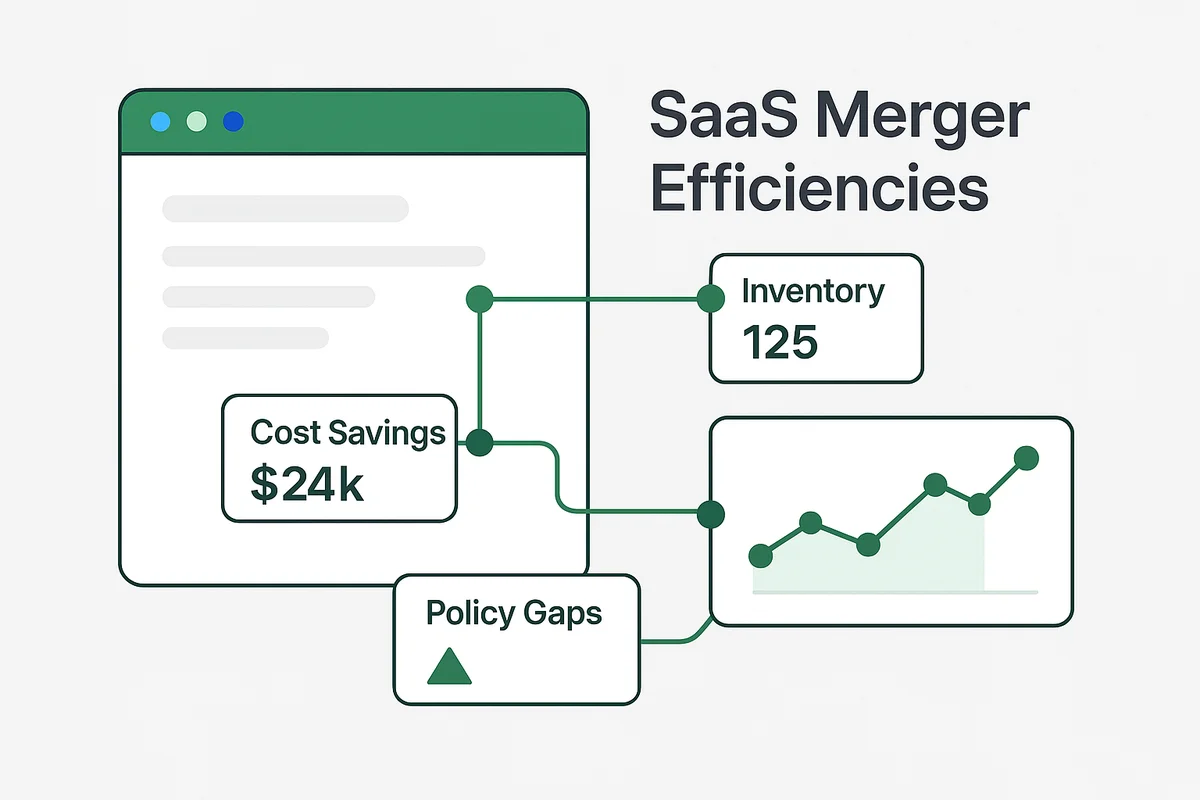

Risk climbs fast when two SaaS stacks merge. A good platform spots the trouble before the auditors do. Direct API hooks to identity tools such as Okta and live finance feeds show what each app stores, who can reach it, and which laws kick in. No manual surveys, no email chase-downs.

The platform lines up every vendor with the rules that apply: SOC 2 for internal controls, GDPR for the EU, HIPAA for protected health data. Gaps stand out immediately. A missing data-processing addendum on a shared file service? Red alert. A marketing app still holding customer records from the acquired firm yet never reviewed by legal gets flagged the same way. Colored risk scores let busy teams rank the next task instead of digging through PDFs.

- Framework tagging: each app lands in one or more buckets such as SOC 2, ISO 27001, GDPR, HIPAA

- Policy engine: rules flag unsigned DPAs, expired certificates, and vendors outside approved regions

- Permission drift: daily scans catch admin rights granted during the transition but never removed

- Evidence locker: logs, attestations, and screenshots store automatically for the next auditor visit

- Slack and email alerts: GRC sees issues in real time instead of at quarter-end

Because the data is live, legal and GRC can make go-or-no-go calls before Day 1. A high-risk CRM can be ring-fenced or retired well before the deal closes, avoiding a pricey remediation later. That same transparency speeds outside audits; evidence sits in one place, so prep time drops sharply.

Security teams also get a company-wide view of entitlements. They watch admin counts fall as roles settle and can show progress toward least-privilege goals to the board without extra scripts. When new apps surface, the policy engine scores them right away, blocking anything that misses the baseline. Ongoing review keeps the stack clean long after integration, so the next acquisition starts from a known-good state.

Ongoing governance that protects post-deal savings

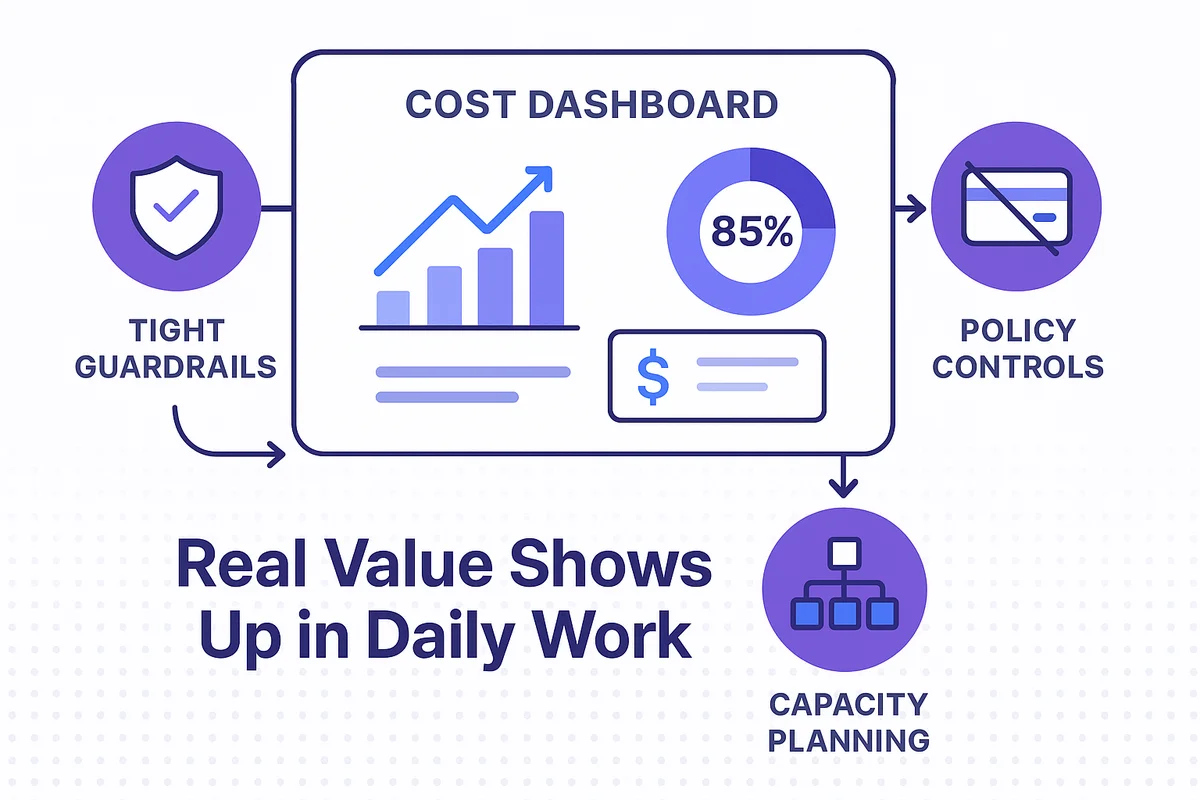

After a merger, the real value shows up or disappears in daily work. Push too fast without guardrails and momentum slips.

A SaaS management platform keeps those guardrails tight. Live cost dashboards line up every invoice with the deal model, letting finance spot realized versus promised synergies as soon as spending moves. Drill-downs call out lines that creep upward, so IT plugs the leak before quarter end instead of justifying it after.

Policy engines handle the routine. If a fresh card swipe launches an unapproved tool, the platform pauses the charge, alerts the requester, and sends an approval task to procurement. No spreadsheet chase, no end of month shock. The same rules track role changes; when an engineer moves to product management, spare dev licenses roll back into the pool automatically.

Capacity planning is easier once HRIS and org chart data flow in. Forecast widgets tie projected headcount to current seats, warning teams when growth will blow past paid tiers or, just as often, when downsizing strands blocks of paid seats. Early notice turns a frantic true up into a calm renegotiation.

Collaboration happens inside the tool, not in email threads.

- A self-service request portal lists approved apps with standard tiers, cutting one-off purchases.

- Shared renewal calendars show legal and finance every contract milestone, so renegotiation prep starts on time.

- Slack and Teams bots answer “how many seats are open on Asana?” without someone chasing reports.

Boards want evidence, not anecdotes. The platform’s end to end history ties every decision to the savings line on the ledger. When the next acquisition lands, IT can clone playbooks, export benchmarks, and forecast year one run rate with confidence.

Conclusion

Once the ink is dry on a deal, a SaaS management platform inventories every app, turns weeks of manual audits into a dashboard, and lets teams tag, flag, and verify the numbers. It cuts unused licenses, organizes upcoming renewals, and clears idle seats, freeing up budget. Every tool gets mapped to policy, gaps surface early, and teams receive alerts long before regulators do. Everything (cost, risk, and growth) lives in one spot, so IT, finance, and GRC work from the same playbook after closing.

That speed and clarity turn the promise of M&A synergy into real results.

Audit your company’s SaaS usage today

If you’re interested in learning more about SaaS Management, let us know. Torii’s SaaS Management Platform can help you:

- Find hidden apps: Use AI to scan your entire company for unauthorized apps. Happens in real-time and is constantly running in the background.

- Cut costs: Save money by removing unused licenses and duplicate tools.

- Implement IT automation: Automate your IT tasks to save time and reduce errors - like offboarding and onboarding automation.

- Get contract renewal alerts: Ensure you don’t miss important contract renewals.

Torii is the industry’s first all-in-one SaaS Management Platform, providing a single source of truth across Finance, IT, and Security.

You can learn more about Torii here.

Frequently Asked Questions

This article explains how a SaaS Management Platform aids in merging two software estates into a single inventory, helping to identify costs, risks, and compliance in M&A situations.

The platform consolidates software records, enabling teams to view every login, payment, and API connection in real-time, thus minimizing risks and costs associated with overlapping applications.

Features like direct API hooks, framework tagging, and a policy engine help identify compliance gaps and manage risks, ensuring adherence to regulations such as GDPR and SOC 2.

Organizations can reduce spend by identifying duplicate licenses and inactive seats, allowing for contract consolidation and efficient license reallocation to maximize existing resources.

Ongoing governance ensures that spent synergies are monitored and compliance maintained through automated alerts and scoped management, enhancing overall operational efficiencies.

The platform aggregates vendor rules, flags compliance issues, and provides audit trails, ensuring that teams are proactive rather than reactive to vendor-related risks.

Companies often experience a 25% to 40% reduction in SaaS spending within the first 90 days by streamlining licenses and optimizing contracts, leading to immediate financial benefits.